Inertia, MSGS, and Why it Makes Sense to Own the Knicks (And Rangers)

Inertia, MSGS, and Why it Makes Sense to Own the Knicks (And Rangers)

The theme of this article and investment is “inertia” and I will eventually get to an in-depth discussion of Madison Square Garden Sports, the owner of the Knicks and Rangers (MSGS). But first, I will go on a bit of a tangent/thought experiment that has always fascinated me and for which I have never seen, read, or heard a suitable and detailed answer: Why didn’t certain all-time basketball greats see the advantages of the 3-point shot earlier and optimize their games?

I am a huge fan of Michael Jordan and Kobe Bryant. Both players are legendary for their focus, work ethic, competitiveness, and addiction to their craft at all costs. Kobe in his book, The Mamba Mentality, writes the… "Referee has a designated slot where he is supposed to be on the floor. When they do that, it creates dead zones. I learned where those zones were, and I took advantage of them. I would get away with holds, travels, and minor violations." This quote was emblematic of their approaches – anything to get an edge. Seemingly, anything except a bit of math, breaking with the norms of the day, and focusing more on 3-pointers.

Both players were capable of everything on the court including the 3-pointer but did not need the 3 to be all-time greats. However, shockingly (though not at the time), neither developed a consistent 3-point shot. Jordan averaged just under 33% from 3 over his career and shot just 1.7 3’s per game. Kobe shot a similar percentage and averaged just 4.1 3’s per game. Two of the top players of all time who were all-time great jump shooters did not prioritize 3-point attempts or percentages and both shot a tremendous amount of the worst shots in basketball, contested mid-range or long 2’s. See here for a great display of how the NBA shot chart has changed over time. I’ll include 2 snippets below. Note this has exponentially changed even over the last 5 years. In ‘97-’98 3-point attempts per game per team were 12.7 vs. last year at 34! Basketball Reference

Why?

We know the math says shooting 33% for a 3-point shot is equivalent to 50% on a 2-point shot (the expected value of each is 1). As an aside, in pickup basketball, for some reason (another rabbit hole with a bit more literature than the topic at hand where the consensus is around ease of doing math), the rules are usually 1’s and 2’s. In this case, 2’s become incredibly valuable, so shoot more “2”s in your local pick-up game. Back to our two subjects, I believe if Kobe or Jordan were entering the league today, they would both shoot 8+ 3’s a game at a 35%+ clip. I think they both would have been more devastating offensively, especially with the spacing available in today’s NBA. What was most amazing about both Jordan and Kobe was their ability to navigate the midrange and make incredibly difficult, contested shots in a congested offense. It is fascinating to think what Kobe/Jordan would develop into assuming they were in their early 20s today and what their games would have looked like.

Here is what Jordan said in 1992:

“My three-point shooting is something I don’t want to excel at because it takes away from all phases of my game. My game is fake, drive to the hole, penetrate, dish-off, dunk. When you have that mentality of making threes, you don’t go to the hole as much. You go to the three-point line and start sitting there, waiting for someone to find you. That’s not my mentality, and I don’t want to create it because it takes away from the other parts of my game.”

Jordan here argues mainly for mentality as his reason, and I urge readers to watch Jordan making 6 3’s in one half of a finals game vs. Clyde Drexler to illustrate what he could do if he wanted to. The media was comparing the two and would consistently give the edge to Clyde as a long-range shooter. Jordan let the world know that was a choice made by him. What is even funnier about the clip is the lack of contest as the other team was shocked to see Jordan attempting that volume of 3s and frankly may have been happy he was doing so. Kobe would perhaps argue the same thing given how much he modeled his game after Jordan. He would likely also cite being a perfectionist or multi-faceted does not translate as well to a game modeled around a consistently high volume of 3-point attempts.

Here is what all-time great shooter Ray Allen said about both players, "I think they were both underrated three-point shooters. When you think about it, if you can do one thing great or a couple of things great, some other things get overshadowed. Mike never really had to shoot threes cause he was so good inside the paint, and Kobe was so good scoring in general. If I had to say between both of them, it's hard because both of them played with their back to the basket. They both were slashers at the rim, and I just don't think their games were designed to sit out there and wait behind the three-point line.”

These are interesting takes from basketball geniuses talking about this exact topic, but I disagree with all of them. In fact, I believe in the future there will be a player who does what Jordan/Kobe did but does it from the 3-point line. We have seen flashes - Harden patented several unique 3-point shots, Curry and Lillard the 35–40 footer, but who can develop that Kobe/Jordan/Carmelo-like mid-range game from deep? Is it possible? I think Kobe or Jordan would have made a run at it if they were coming into the league today. Kobe was clearly capable of making the high level of difficulty shot from downtown: Kobe hits 3 straight difficult 3's in 2013.

Here is an absolutely fascinating article on the topic by fivethirtyeight. It details a discussion on Tracy McGrady vs. James Harden and Kevin Garnett vs Anthony Davis. It hits on long-2s and midrange jumpers and how each career would be different if you adjusted the player’s shots appropriately (i.e. moving long 2s to 3s). Interestingly, percentages on long 2s are very similar to 3-pointers which is why the shot selection of NBA teams has changed so dramatically. This is why I don’t think you’d see Kobe and Jordan’s shot percentage dip much had they worked on developing their game to get up 8+ 3’s per game.

The best pushback, which I got from a family member, was the value of the old school “And-1” 3-point plays and getting the other team in foul trouble. Additionally, their in-game dunks would demoralize opponents. There is no doubt that free throws, getting teams in foul trouble, and “intangibles” are valuable - Jordan was a career 83.5% FT shooter at 8.2/game, while Kobe was at 83.7% at 7.4/game and both were prolific in-game dunkers. This could arguably be added to the mentality defense Jordan lists above. While this was a good retort, there are players like James Harden, who even including his years where he didn’t have as heavy of usage in Oklahoma City, for his career averages 7.6 3’s attempted/game and also a remarkable 8.6 FTA/game. Harden, to caveat, has clearly played in an era more advantageous towards the offensive player.

I find the somewhat minimal dialogue on the topic interesting, but the only real answer in my opinion is inertia. They didn’t shoot 3s because no one else did. The best players in the league were not 3-point shooters. They must have known the math, but it was just something people didn’t do. The 3 was incredibly undervalued and the players, known for doing anything to win, couldn’t overcome the societal influences. I would note that this isn’t unique to basketball, and we have seen similar transformations in baseball and football (though sports where 1 player has a more limited impact), but I still do think Kobe/Jordan could have figured this out and changed the game more quickly.

If anyone has seen any articles or has in-depth thoughts on the above, I would love to connect or be sent any relevant pieces. I may do a larger article on the matter in the future as maybe the answer is not so simple, and I am missing some major drivers.

MSGS

Now back to regularly scheduled programming – MSGS, the reason we are here today. The Knicks have arguably been poorly run consistently for 40+ years and MSGS’s share price has mirrored the product on the floor over the last half-decade, however, the compounding of the value of the underlying asset has been tremendous over the short and long-term.

Since MSGS became a standalone company in April of 2020, the share price has stayed the same, however, the Knicks and Rangers’ Forbes values have moved from $4.6B and $1.7B to $6.1B and $2.2B respectively, or an increase in NAV of $2B or ~$83/share.

Company Description

MSGS includes the ownership of the NY Knicks, NY Rangers, and of FAR less importance two development league teams, a sports performance center, and a noncontrolling investment into an esports and gaming franchise. MSGS trades at an EV of $4.4B vs. my predicted value of ~$10.2B in a combined sale. The company now exists due to several spin-offs from Cable Vision to MSGS today. Additionally, while I don’t believe the business’s actual operations are critical to its value, it was nonetheless exciting to peek behind the curtain to learn about the operations of owning a sports team (my personal dream). I will go into detail on this later in the article.

Executive Summary:

I noticed a key inflection point last year in what I believed to be a real potential for a high-profile value realization at a premium to Forbes values in the NBA (Phoenix Suns) along with other key catalysts coming closer and closer to fruition. At the time, I talked to a dozen people about MSGS, and no one cared, was interested, or even knew how the business worked which I thought was interesting given the trophy nature of these assets along with the overlap of interest b/w sports and investing. The common reason was that Dolan (the team owner) sucks, he’ll never sell, and the discount won’t close, aka inertia. I am sure I will get some comments to that end on this article. The status quo will stay the status quo. NY investors were especially bitter when the idea was brought up (I can’t blame them). I believe this perception will change and the value of the asset will become more accurately priced as various hard and soft catalysts come to fruition.

Along with what I believed to be several upcoming short and medium-term catalysts; in September/October of 2022, the shares had traded at the largest discount to NAV since MSGS became a standalone business along with multi-year lows in the stock. The stock was around $140 when I was pounding the table and it appreciated to well over ~$200 but has settled back down around $175 where I see strong value and nice asymmetry. Despite some of the IRR realized today, I still believe it's an attractive investment and am increasing my position on any dips. This is not an investment where you will get rich, but more about asymmetry and lack of correlation to my other holdings.

The key tenets of the thesis are below:

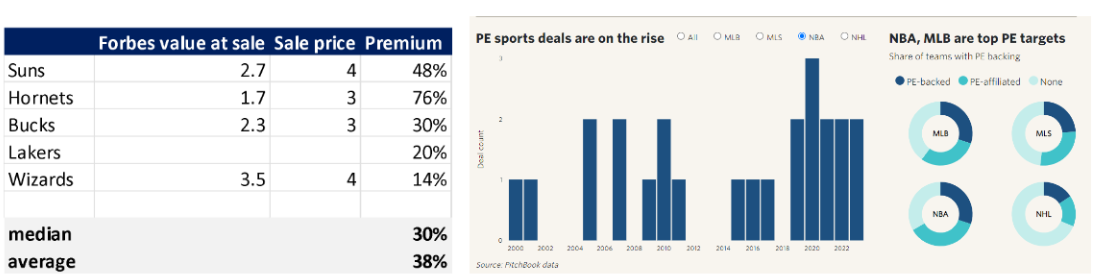

Valuation and Discount to NAV: Knicks ($6.1B) and Rangers ($2.2B) are worth $8.3B combined according to Forbes estimated values. However, based on the past 5 NBA transactions relative to Forbes values. there was an average 38% premium paid which gets us to well over $10B in a potential sale assuming the Rangers trade for their Forbes values. As another data point, Sportico values the Knicks at ~$6.6B.

MSGS allows an investor to buy a top 2 asset (Warriors viewed as most valuable) in the top 2 professional sports league (in the US) at roughly 50-60 cents on the dollar with a free hockey team thrown in for good measure. The math of ~$10B at sale equates to roughly ~$416/share gross of any potential tax burden.

Downside Protection: James Dolan repeatedly says he is not selling. If there is no sale, partial sale, etc… we would just grow with team value which has CAGR’d in the double digits over time. The discount to NAV could certainly be widened, but I view this as unlikely given the catalysts I will detail later and the current levels of the discount being at or near their widest.

The downside is likely an inflation plus NAV growth calculation along with a small amount of FCF over time (~1-3% or so of market cap today). I believe returns end up being around the 5-10% range over time assuming no value realization. The bond+ downside is countered with a 100%+ upside if the discount closes to Forbes figures or higher in the event of a sale at a premium.

Sports teams’ values in the NBA have grown at double-digit CAGRs over the last 15 years, and for the Knicks, this has been above a 20% CAGR since 2010 with the Rangers in the low double digits. Believe it or not, the Knicks’ Forbes value in 2010 was just ~$600M, a 10x since that time.

Jerry Buss purchased the Lakers in 1979 (he also got the Kings and the Forum Arena) for $67M and assuming the Lakers are worth $6B today (no credit for Kings/Forum), the CAGR for this purchase is a remarkable ~11% and including the value of the Kings it would be a >100x if he had held both until today. This 11% is vs. the SPY at 7.75% over that same time frame.

Each team is a local monopoly within a nationwide monopoly and the Knicks and the NBA are best of breed. This is not to say this will continue, but it is nonetheless incredibly impressive and longevity begets longevity.

Catalysts: We have had a plethora of recent pricings in the marketplace which I have shown below in the table on the left. The increasing PE participation is on the right. The NBA recently in 2022 allowed ownership by pensions, university endowments, and sovereign wealth funds which will lead to further increasing liquidity and more valuation comparables.

Other catalysts include a new media rights deal in ’24-’25 (set to in my view at least double annual revenues relative to the current deal – a double is worth ~$45M (~$2/share) in FCF/yr to MSGS), increasing PE involvement and institutional capital investment (according to Pitchbook 20 of 30 teams have a PE connection), the increasing prevalence of sports gambling and its effect on advertising revenues, two expansion teams in Vegas and Seattle (which if valued at $4.5B each leads to $300M, or $12.55/share in the pocket of each current owner), and the potential of a marquee free agent signing along with sustained team success.

Finally, James Dolan’s father is currently in his mid-90s and if he were to pass away it would perhaps trigger changes that could lead to a value realization (this situation led to a Denver Broncos sale recently). Additionally, management acknowledges the discount to NAV is too wide, and Dolan has suggested in the past that he would be amenable to a sale of the teams at the right price, and his passion clearly lies in art, entertainment, Sphere (which has recently opened) etc… Please check out this article which features quotes from Dolan like:

“Being a professional sports owner in New York, you’re not beloved until you’re dead.” and

He doesn’t “really like owning teams.”

The Ultimate Rich Ego Purchase: The first 3 points of the thesis are somewhat well-known, although I believe Dolan is much more likely to sell the team than the market believes, and I think it is under-discounting the institutionalizing of the asset class. However, my thesis conviction ultimately rests upon the ego of rich men which I would say has passed the test of time. There are a limited number of ways to be the “guy” in a city and the best way is to own the sports team and create success. The Knicks are at a whole different level in this regard. There are ~130 billionaires in NY. How much would they pay (perhaps along with PE) to be the most beloved person in the city? That is a great supply and demand mismatch. I am extremely confident in this tenet of the thesis.

New York is arguably the most important city in America, perhaps the world – Bezos, Cohen, any other rich person etc… would love to own this team. It is a one-of-one asset right up there with the Yankees.

The answer to me on what this is worth is “priceless.” I think Joe Lacob really helped pave the way for this, an anonymous person who became the guy in SF and is now well-known throughout the country. Imagine bringing the Knicks their first title in 50 years –- you would be a hero.

The Under Discussed Key – Depreciation: This investment should be classified as something akin to fine art in that its value is dependent on what rich people pay for it, its value will likely increase over time, and it isn’t going to produce (a lot of) cash flow. However, owners can depreciate the vast majority of their purchase price over 15 years. So, you get an appreciating asset, you get to be the “guy” and a giant tax deduction (something very appealing for hedge funds or PE magnates). This treatment has in my opinion been the #1 or #2 reason for continual increases in sports teams’ values and is also discussed less than the first 3 points of the thesis.

The rest of the article will largely discuss the business operations that are not as important to the value of the business as what I covered above. At the end, I will walk through the risks to the thesis and my pushbacks.

Revenues (FYE is June)

Revenues are split between games/event-related at ~41% (tickets, suites, merchandise, food, and beverage), TV rights (national and local) at ~34%, advertising/sponsorship at ~22%, and “other” as the remainder. In 2022 the first non-Covid-effected period as a standalone company, MSGS generated $820M and $115M in adjusted operating income (adds back minimal D&A and egregious $25M of SBC, however, it does not include the difference b/w cash expense and GAAP lease expense paid for the Garden which is around ~$25M making the adjusted figure roughly accurate in my view). As a result, cash flow was roughly ~$25M higher than operating income last year.

Playoffs are huge generators of operating income with each additional game often generating $3M+ of operating income and $6M+ of revenues. There is positive optionality when both teams make deep playoff runs for business operations. Revenue increased further in 2023 to $887M with a similar amount of operating income (business was not very efficient growing expenses just as much as revenues in dollars not percentages). It is important to note that MSGE and MSGS were combined and financially intertwined through 2020 thus making longer-term financial analysis difficult, so I believe these two periods are likely the best avenues for forecasting future performance.

Tickets and Concessions ($363M): The team sells tickets, merchandise, and concessions to fans. Season ticket churn rates are in the single digits (the combined renewal rate of Knicks/Rangers was 93% in 2023) so this revenue is in essence almost fully recurring. Tickets are the largest revenue line item and MSGS keeps 100% of the proceeds. Concessions/merchandise have a different revenue model, but regarding tickets, there are roughly 41 regular season games per year per team along with a couple of preseason games and depending on team success a couple or a dozen or so playoff games. The company does not provide breakouts b/w tickets, concessions and merchandise, but concessions/merchandise are typically viewed as a percentage of revenue. The average Knicks ticket is around $150-$200, and you can expect concessions/merchandise to be anywhere from 15-35% of that price. Playoff games essentially have increased ticket prices by 50%+.

None of the details are disclosed, so the following are my educated guesses - I will not make this writeup longer by showing the actual model, but instead will just walk through a brief unit economics exercise. ~19.5k fans, ~$160/seat equates to ~$3.1M/game in tickets. Assuming 44 games including preseason, we get ~$137M in tickets. Add 25% of ~$137M to get to tickets + concessions/merchandise revenues at ~$171.5M. Assuming Rangers tickets are ~$125/game we get to ~$110M, adding concessions/merchandise in gets you to ~$137.5M. The two combined get you ~$309M. This gives the remainder of ~$54M. Playoffs will generally add or subtract from the above and the above can vary and my assumptions could be wrong as to the makeup. In 2023, there were 8 playoff games which led to around ~$54M of additional revenues which is right around the company’s estimate of ~$6-7M/playoff game.

MSGS keeps 50% of the profits for concessions (splitting it with MSGE) and has a 30% royalty on all merchandise paid to MSGE.

TV Rights and Media ($289M): The company earns recurring revenue through both national and local contracts. The current national media rights revenues are around $110-120M for both teams combined with the NBA making up the vast majority. I calculate the NBA contract value based on roughly $2.6B/annum over 30 teams = roughly $85M/team which many experts expect to double in ‘24/25. The last deal prior to the most recent NBA deal was <$1B/yr. The NHL contract is $250M/season or roughly $9M/team, but there are sub-contracts within that which get the total figure higher. The NHL recently struck a deal in 2021 with ESPN at over $400M/season or ~$13M/team. There are also some radio revenues in here and other small line items.

Local TV networks are a major line item for the Knicks and not so much for other teams (the Suns new owner decided to just take a 0 here and show all games for free). The Knicks will make over $170M from local TV and this deal increases at 4% per annum and ends in 2035.

Both local and national are recurring revenues which are essentially all margin to the team and come with limited incremental costs (note the league-wide TV deals do affect salary caps).

Advertising ($196M): The company generates its advertising revenue via signage, sponsors, and suite licenses at Madison Square Garden of which sports gambling has become their largest single industry advertising group. The Knicks recently began selling a spot on the jersey for which they are now targeting $30M/season. As mentioned, suites are also in this category and the Garden has roughly 110, but pricing is not disclosed. However, MSGS is entitled to roughly 34% of all suite revenues while the rest goes to MSGE. I was not able to understand the detailed split in this category. In theory, this revenue is likely less recurring, but suites also have low churn and advertising revenue has been increasing as a result of the sports gambling effect – this segment was up $24M YoY.

Other (Company/Street assumes ~$40M): This other section consists primarily (I think) of the Knicks’ share on a variety of league distributions including royalties, trademarks, playoff revenue rebates, and luxury tax rebates distributed by teams over the luxury tax. This is the segment I have the least handle on, and I believe it could fluctuate wildly, especially with regard to the luxury tax. There are also new salary cap rules coming which could affect this line item.

Expenses:

The company has many different expenses which are very difficult to categorize. In 2023 there was $548M of total direct operating expenses and $250M of SG&A for a total of $798M. The main direct expenses consist of course players and personnel salaries. The Knicks payroll (players) alone is ~$170M for the upcoming season while the Rangers is roughly ~$80M for a combined ~$250M.

Coaching, game-day expenses, and other staff are likely material. For instance, head coach Tom Thibedeau makes $8M/yr. Let's say combined team-related staffing is ~$60M. On the income statement, the lease expense is ~$67M, but the cash expense is around $40M. Adding up team-related staffing, income statement lease expenses, and player expenses we get to $377M.

Other direct costs paid to MSGE are $33M in addition to the lease expense which gets us to $410M. The remainder of direct expenses is other costs outside of salaries including travel, insurance, league revenue sharing (~$50M+), league tax of 6% on ticket sales, various other taxes, game-day operations such as cost of merchandise, training center, D-League operations, and more. I still am not sure how to get to $548M, but the majority is explained.

SG&A of $250M consists mainly of corporate staff as well as fees that MSGS pays to MSGE for advertising, back office, and more, as well as additional advertising and marketing costs. Roughly $60M of costs in this category go to MSGE. Company executives and SBC are also included in this category. However, I have no idea how this gets to $250M. I believe there is A LOT of fat to cut here for a potential acquirer. There are many unexplained costs, and this company again is NOT run for cash flow or for efficiency.

Margins and Cash Flow

As far as margin, there is not a full swath of data across teams and leagues. There is an interesting website, of which I do not know the efficacy of, called runrepeat.com which shows the Knicks among the best of breed as far as average margins go across the league with most of the league operating right around breakeven. However, the cost structure is quite bloated and much more expensive than other teams. There is a clear opportunity for improvement under a different owner to improve margins and in turn cash flow.

It is difficult to look at historic periods and find a reliable estimate of cash flow over time. However, the business does generate cash flow. Estimates from the street tend to center around ~$100M or so per year without the benefits of expected media contract increases, sports gambling upside, and playoff potential. There is limited capex, so the business can buy back shares or pay special dividends from this cash flow which the company did last year - a $175M special dividend and a $75M buyback. I believe this can/will continue especially with the discount to NAV continuing to stay wide. Hopefully, it is more buybacks than dividends given the share price. Assuming around $125M conservatively of cash flow post-media deal, and a current market cap today of ~$4.2B, we have a relatively unexciting yield of ~3%, but a yield nonetheless.

Industry:

The NBA has ascended since its founding in 1946 and this has accelerated due to the increasing penetration of TV/media deals, international growth, sports gambling expansion, and the newer amortization and tax benefits. The NBA had many tough periods, but for the most part, has seen sustained success since the Magic/Bird and David Stren era. From 1998-2022, according to Forbes, NBA team values CAGR’d at an incredible ~12%. The NBA’s revenues have CAGR’d at lower levels but still are estimated to have grown in the high-single-digits over the last 20 years and at around 10% over the last decade. The NHL also has seen strong growth – according to Statista, the NHL has had revenue increases of around 6% over the last decade.

The Knicks' valuation over the last decade has actually grown at 23% per annum with the Rangers at 11%. Using 2012 as the base year the Knicks’ value was $780M and the Rangers’ $750M vs. today $6.1B and $2.2B respectively.

I believe the top sports leagues are monopolies in nature, though this has come under fire lately with the Saudis throwing billions of dollars around. I don’t believe they will come after the NBA/NHL, but it is a minor risk. The teams within the league are local monopolies. I find the threat of new entry to be extremely low for the Knicks/Rangers. We saw how little the Brooklyn Nets affected the Knicks despite the superior talent and investment.

As far as cyclicality goes, it is difficult to tell, but I would guess team values would be somewhat cyclical despite the lack of cyclicality from the underlying business due to contracted TV/streaming as well as minor declines in stadium revenue during financial recessions. As a data point, NBA revenues were roughly flat from 2008-2010.

Moat and Differentiation

The Knicks and Rangers are best-of-breed assets in their respective leagues accordingly placing in the top 2 in value for the NBA and the top in the NHL according to Forbes. While the Rangers franchise has been somewhat successful the Knicks hold this value despite what can only be described as nearing 50 years of misery, mismanagement, and heartbreak. There are only 9 cities in the US with 1M people, none of which have the wealth and rabid fan base of NY outside of maybe LA/SF. They also play in the most famous arena in sports with higher local TV revenue than any other team.

NY itself has some downside in that it has extremely high taxes and the history of mismanagement has perhaps lessened the appeal for free agents. The teams compete with other sports leagues/teams and any other form of entertainment for attention, ad dollars, etc… but I am comfortable betting on the durability of live sports. The Knicks/Rangers, much like Disney, create new customers each year when Knicks/Rangers adults have children. This loyalty and commitment to sports teams is as American as it gets.

The Knicks/Rangers have strong leverage over their customers (fans, advertisers) and this is shown by unwavering support despite the Knicks record and questionable owner and front-office decisions. Knick fans are excited just to have hope or a team who shows effort. They really love their current team despite not having a real shot at winning a title. I believe the Knicks franchise has turned a real corner and the inertia over the last 40+ years is dissipating. I wouldn’t be surprised to see sustained success in NY which could also help the valuation.

One of the reasons I was initially attracted to this investment was in fact the strong team I saw heading into 2022 who I thought would definitely make the playoffs and could maybe win a round. That is what happened and I do think this helps the underlying value even though the actual cash generation value is immaterial. However, when an organization shows competence, competitiveness, and talent, you can attract the star that Knick fans have been craving. I believe there is a really strong possibility a star will go to NY over the next couple of years.

Due to the shifting landscape in TV and streaming, live sports are the last appointment TV viewing we still have remaining in the US. The NBA/NHL are becoming more valuable to advertisers for that reason. The NFL has the highest advertising rates globally. Live sports are increasing in value (and are the key) to the cable bundle. There is also a plethora of new potential bidders for rights with Amazon, Apple, Google, etc… potentially involved in the future revenue streams of the league.

Interestingly leverage vs. suppliers or in this case players and coaches is quite low. The “player empowerment” era is upon us catalyzed by Lebron James’ Decision to go to Miami earlier in the last decade. Players routinely ask for trades, demand whatever they want, and often get just that. Additionally, as discussed earlier, you have a history of poor performance for the Knicks as well as higher state taxes working against you. On the other hand, you have a lot of off-the-court opportunities for players in the city.

Depreciation and Tax Laws:

The most under-appreciated variable in the rise of the value of sports teams is the ability to depreciate most of the purchase price of a team. According to many sources, including Propublica (read this article its really good), teams in 2004 were now able to utilize amortization when purchasing a team, unsurprisingly signed by President George W Bush, who himself was a part owner of the Texas Rangers. The estimates for write-offs of purchase value ranged from roughly 50-90% from what I was able to hunt down. The article linked above discusses David Tepper who purchased the Carolina Panthers for $2.3B. The article estimates the taxable offset could be around $140M/yr. Despite the ability to amortize the purchase, we know the “depreciation” of assets isn’t real in sports like in a manufacturing company. Sports teams in the NBA in actuality are closer to fine art or land and there is no capex. This is a meaningful tax shelter for rich owners. Additionally, minority owners think PE funds or other HNW individuals, could also benefit.

From the above article, “Bob Piccinini was a minority member of the group that purchased the Golden State Warriors in 2010. He made his fortune turning Modesto-based Save Mart Supermarkets into the largest family-owned grocery chain in California. Already a part owner of multiple baseball teams, he entered the basketball world not because he had a particularly keen interest in the sport, but to make money. “Sports franchises continue to go up in value,” Piccinini said at the time.

His tax information shows he bought more than 7% of the Warriors. From 2011 to 2014, he reported total losses of $16 million. Nearly a decade’s worth of tax data from other Warriors owners, also reviewed by ProPublica, showed many millions in losses — all of it during a period when the team rose to become historically dominant. Meanwhile, leaked financials obtained by ESPN from 2017 show the Warriors to be an extremely profitable business, netting $92 million in one season alone. Forbes estimates also put the team well in the black during that period. A Warriors spokesperson declined to answer a series of specific questions, instead providing a one-sentence statement: “Over the course of the last decade, we have invested hundreds of millions of dollars into our team on the court, our overall operation and, of course, the construction and opening of a new, 100 percent privately financed arena in San Francisco. Piccinini died in 2015. The court records about the inheritance he left his children don’t specifically mention his stake in the team or whether his estate paid taxes following his death. But the tax code likely would have allowed his children never to repay the government for the paper losses their father enjoyed. It would also have permitted Piccinni’s heirs to begin claiming paper losses of their own.”

There are other great examples such as Steve Balmer’s purchase of the Clippers featured in the article. A big risk is this policy changing, but rich people rarely lose tax loopholes. This “loophole” massively reduced the true cost of buying a sports team.

Balance Sheet

The company has ~$325M of debt which is not a concern given the team value. The league has leverage limits for all teams and is one of the primary reasons the business was separated from MSGE. There are some unusual assets/liabilities on the balance sheet that are interesting to understand, but ultimately not material to our discussion today.

Management

Despite this being the biggest reason the stock trades at a discount to NAV, the Dolans have done quite well over the long-term, mainly James Dolan’s father, outperforming the SPY meaningfully over time at predecessor entities. We are well-aligned with James Dolan in that he owns 20% of the equity. The Dolan family has managed MSGS for decades and James Dolan in particular is criticized as a terrible owner. James pays himself as well as other executives quite generously.

The compensation goals for the business are strong with the vast majority of pay at risk and longer-term for top executives, although SBC is clearly too high. Despite the lack of team success, the value of the assets has moved up significantly and ahead of peers. The team generates FCF which is unique in the league. I do think there could be a lot of expense reduction if the team was run more efficiently, but again it is not really an important determinant in the value to a new owner.

As Buffet stated, “They say in the stock market, ‘Buy into a business that’s doing so well an idiot could run it, because sooner or later, one will,” I believe that is the case here – good management may help, but as far as the stock and value goes there really is not a lot of people that could screw this up, including the Dolans.

Opportunity/Conclusion:

As mentioned above this is an opportunity to own one-of-a-kind, monopoly assets at a significant discount to intrinsic value. The hypothetical return or IRR is based upon team value growth (historically double digits), FCF roughly 0-3% of market cap per annum but step-function increase in 2 years with potential for more upon league expansion, and discount to NAV Closure (would take roughly 100% return to get to Forbes values which are generally below actual sales values). I think a downside case is NAV growth matches inflation (2-4%), FCF at 1%, and discount to NAV never closes while an upside scenario would imply HSD NAV growth (7-9%), FCF at 3%, and discount to NAV closes in 5 years (100% upside in 5 years).

Valuation:

The cost basis of the purchase is quite low, so I utilize a blended 19% tax rate and assume there is no tax shield available to shareholders at exit. My guess is that in actuality you could more eloquently structure a transaction to have a higher exit value.

Key Risks

Dolan discount/never sells/screws over shareholders somehow upon sale.

We are minority shareholders and thus decisions can be made by Dolan without our consent. This is the largest risk.

Pushbacks:

Discount/Never Sell - I believe there is an increasing likelihood of a partial sale, total sale, etc… which is not priced into the market and will close the discount. Given the level of the discount, even if over 10 years (roughly 7% CAGR), it is meaningful to IRR.

Screws over Shareholders: I have spoken with some bankers, lawyers, and investors and there does not seem to be any reasonable way to screw over minorities in the event of a sale. There are some intelligent value investors among the top shareholders in the company which would put up a battle if this were to occur. Dolan has other public entities that would also suffer.

Not selling the Knicks in the past has clearly been a great move.

Over the long run the Dolan’s have outperformed the SPY. Cablevision went public in 1986 and sold in 2016: +3600% vs. SPY 1900%.

As mentioned above, the assets are so good, that they overcome poor mgmt.

Value Trap and the business doesn’t earn much money.

Sports teams could be at their peak, and the discount to NAV can always widen. Ben Thompson of Stratechery has some solid points on the future of the NBA being in doubt, mainly as a result of the failing cable bundle and younger audiences no longer watching entire games.

Pushback: I continue to see NAV growth (albeit at lower levels) and catalysts upcoming which will close the discount. These catalysts are not appreciated by the market and I see downside protection due to the large discount to my view of NAV. The company does return capital as evidenced by a $250M return of capital in 2022. I think Ben Thompson has good points, I just think the value of live sports is evident and will increase in value. Monetization of the product, while important to the league, may not impact teams’ values as these assets do not trade on FCF or any earnings metric.

Saudi/New League risk

The NBA could be disrupted by large offers to top players. There could be a competing league.

Pushback: I don’t believe there is a real risk here.

Lack of potential buyers given the cost of the asset

Pushback: I don’t view this as credible, but given the price tag there is a limited list of potential buyers

Other options – Braves (Liberty), MANU, etc… may be better ways to own professional sports teams.

Pushback – I want to own best of breed both in terms of sports league and team within that sports league. NYK is the top NBA asset in my opinion. The Braves are not a top asset in baseball which is a declining league in my view. I don’t know as much about soccer, so MANU doesn’t interest me as much. I am open to other ideas, but in my view, the Knicks are only rivaled by the Yankees, Lakers, Cowboys, and a few others in American sports and are available at a large discount.

Disclaimer: The information provided in this report is for general informational purposes only and should not be construed as investment advice. The author of this article is not a licensed financial advisor and does not guarantee the accuracy, completeness, or timeliness of any information presented herein. Investing in securities or other financial products involves risk, and the reader should carefully consider their own investment objectives, risk tolerance, and financial situation before making any investment decisions. The reader should also consult with a licensed financial advisor or other professional before making any investment decisions. The author of this article will not be held responsible for any losses or damages resulting from any investment decisions made based on the information presented in this article.