Unveiling an Asymmetric Opportunity: Anterix (ATEX) and Lucrative 900-MHz Spectrum

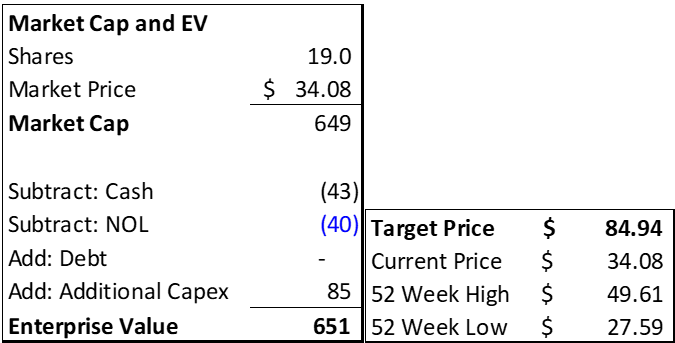

Company Statistics

Executive Summary

Anterix (ATEX) is the largest owner of 900-MHz spectrum (please don’t stop reading, I know spectrum has not been a fun experience for many), which allows for wireless communication. 900-MHz spectrum has low frequencies and density but can cover large areas. This is incredibly valuable to utilities who need to own their spectrum for security, reliability, flexibility, and sometimes compliance purposes (ATEX’s end customer).

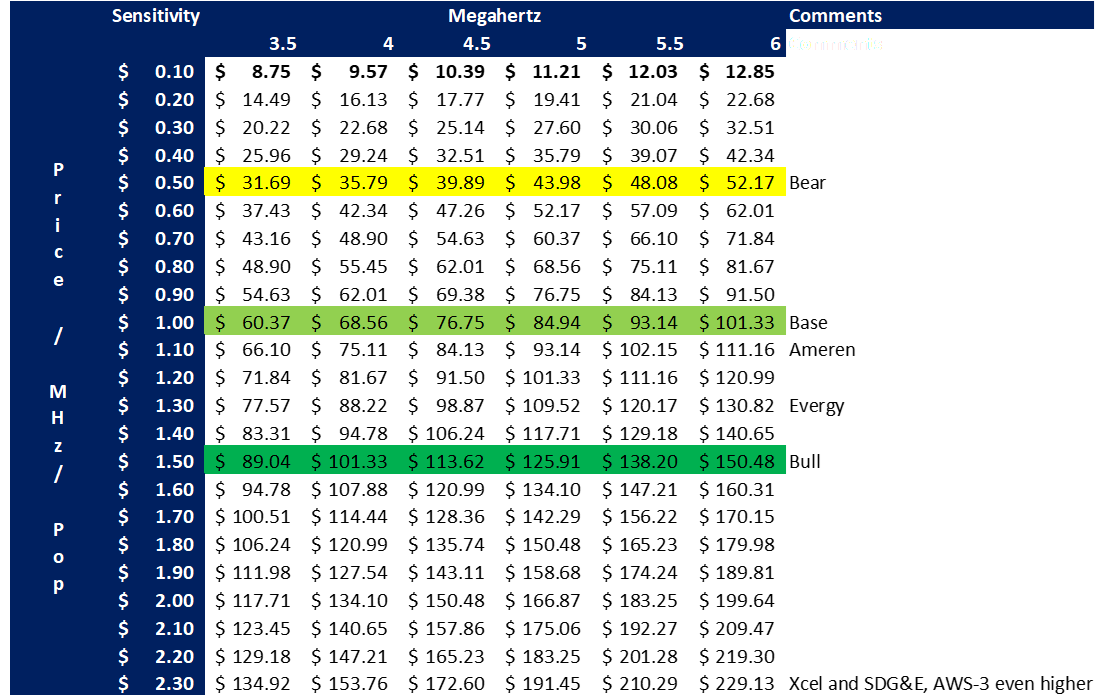

Shares today imply just ~$.34 MHz/Pop, which is less than the company was trading at before it received FCC approval a few years ago to execute this spectrum transition and much less than ATEX has priced its spectrum (all 5 contracts above $1 MHz/Pop) in various signed contracts or comparable market transactions. The business is uncorrelated with the general market and has a great balance sheet. It will likely have contracted proceeds over just the next 2-3 years worth significantly more than the current EV with multiples of upside. I believe the company is worth approximately 2.5x its current share price with limited downside over a 3-5 year time frame.

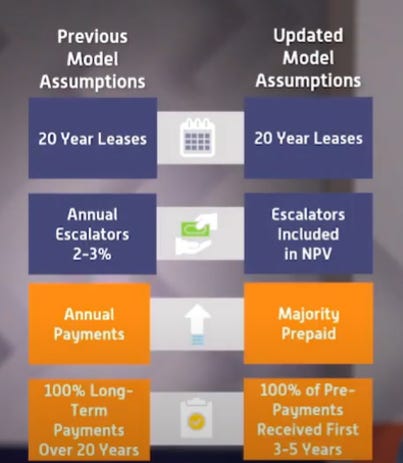

Originally, the company anticipated leasing their spectrum on an annual basis over 20-40 years. However, the situation unfolded differently, and they are now selling their spectrum outright or receiving upfront payments for the entire duration of a standard lease, but on similar terms. See below from the company’s investor presentation.

This raises the likelihood of shareholders experiencing special dividends and stock buybacks in the near term, although these outcomes may be less predictable and more irregular compared to the conventional leasing approach. As a result, the company's profile at maturity differs from high-multiple tower companies, despite the expectation of indefinite renewals for the 20-40-year contracts. While I look at MHz/Pop, others could put a multiple on the normalized cash flows. This new model is a positive for me who is comfortable with lumpy volatility, but a negative for the share price in the shorter term as most investors like steady, predictable, and growing cash flow.

Background

ATEX has over 50% of the total 900 MHz spectrum that the FCC has cleared. It acquired these rights from Sprint in 2014 for roughly $100M. It was able to be purchased at this level because ATEX had to petition the FTC to approve the spectrum’s reallocation and spend over $100M in capex over time to properly provide the current spectrum to their customers. ATEX became the de facto exclusive provider of this spectrum because of the approval granted 6 years later in 2020.

With the evolution of electricity delivery to end consumers, numerous vulnerable points of failure have emerged for utilities, necessitating the adoption of private wireless connectivity as the primary solution. Low-band wireless, known for its extended range and resilience against obstacles like buildings, has become the preferred choice. Utilities need and will pay for spectrum and are unlikely to buy it themselves given the level of cost required. ATEX’s spectrum fills this need perfectly. See Appendix for ATEX’s description of their value proposition

Why is ATEX mispriced?

I believe the poor share price performance is largely the result of management missing expectations, short-term oriented markets, and concentrated ownership rather than a change in the intrinsic value of the asset. Bears would correctly argue that management has set high expectations of leases and contracted value and repeatedly failed to execute. Bulls and management would argue that utilities move at a slow pace which they underestimated. I have worked for companies like these utilities and they are anything but efficient, so this slow pace to do something new and semi-innovative does not surprise me one iota. To me, this is more of a when, not if, story.

The big question is whether or not the ATEX story has fundamentally changed – will there no longer be demand for private spectrum from utilities? Is there real competition? Can management execute any deals? I would argue that the answers to all these questions are positive for ATEX.

How do we know there is demand for the project and management can sign deals?

Known customer universe: Majority of potential customers engaged by management who have subsequently indicated their interest.

Confidence in contracting: Despite revised expectations, management has shown high confidence in securing significant contracting opportunities, exceeding $2 billion, in the past.

Signed contracts: The company has already secured five contracts, providing tangible evidence of existing demand.

Grid modernization and digital transformation: Nationwide efforts to modernize the grid and adapt to digital advancements create a pressing need for utilities to have flexible and controlled communication systems.

Addressing cyber threats: The rising prevalence of public cyber threats further underscores the importance of utilities having autonomy over their communications.

Favorable customer dynamics: Utilities can invest in this spectrum with confidence, as they earn a predetermined return on their investments, and pricing concerns are minimal.

Lack of credible competition: Besides continuing to go with the status quo, as far as I know, there are no other similar competitive offerings for this service.

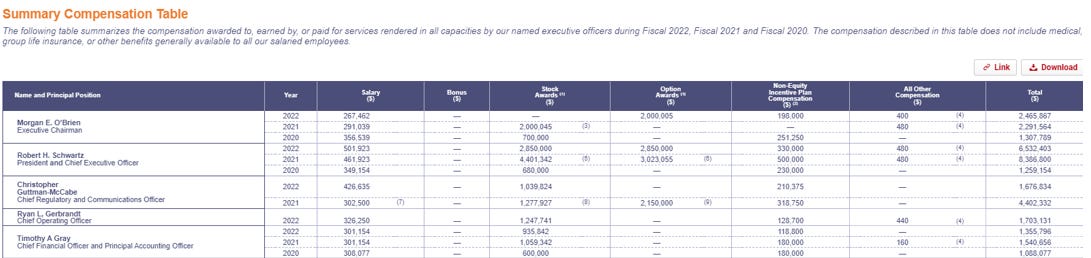

Management

The management team of ATEX initially (Brian McAuley and Morgan O’Brien) were former Nextel managers/founders. Nextel's utilized 800-MHz Specialized Mobile Radio band pioneered a "walkie-talkie" feature in addition to direct-dialed voice calls. Nextel was one of the first providers in the United States to offer a national digital cellular coverage footprint. Nextel merged with Sprint when it was valued at a $36B valuation in 2005. The ATEX team has very relevant experience and has had past success.

Compensation has been egregious relative to company performance and management’s performance against its own goals. Luckily, Owl Creek, the largest shareholder has recently (Feb ’23) had their founder join the company’s board. I suspect that a better focus and more aligned compensation will occur moving forward. I think G&A is also too high, and this will be corrected in the coming years. I think this is an important catalyst for near-term value creation.

Valuation

The valuation can be done in a couple of ways. I focus on MHz/Pop model just for ease of use. You can also build out a DCF, but I find that difficult in a company with this level of cash flow uncertainty. In my sensitivity table below, it is very difficult to obtain a value below current share prices. The level of upside in the base case is large, and even if this takes 5 years to occur, my IRR is >20% which is attractive for an uncorrelated asset with little downside.

Appendix:

ATEX on the business opportunity from their recent 10-K.

We have currently identified utility and critical infrastructure enterprises as the primary customers for our current and future broadband spectrum assets. We have identified the electric utility industry as our initial focused customer group. We believe that security, priority access, latency, redundancy, private ownership, control, and unique coverage requirements are just some of the reasons utility and critical infrastructure enterprises would be interested in obtaining rights to deploy private wireless broadband networks, technologies and solutions that can be enabled through use of our licensed spectrum.

The electric utility industry is undergoing a fundamental transformation. Grid modernization efforts and the drive to reduce carbon emissions have disrupted the need for utilities to build new large-scale, centralized facilities. Today, power is generated by smaller, more geographically distributed facilities that can switch from a power producer to a recipient of power generated by a variety of other disparate sources, including wind and solar installations. Grid architecture must now accommodate end-users that are both generators and consumers, converting back and forth rapidly and carrying power in both directions, something the existing grid was not originally designed to handle. Technological advancements have produced sensors and smart devices to enable the new two-way grid and offer operators the ability to control and run the grid efficiently, safely, and reliably. Wireless communication networks, technologies, and solutions can help utilities move the large volumes of data generated by these sensors and smart devices to their control systems for decision making, analytics and responsiveness to market demand and emergencies. The legacy communications systems utilized by many utilities have increasing interference and/or higher cyber threats, are not designed to handle this new data load, are inefficient and costly to maintain, and, in many cases, have associated equipment that is approaching end of life.

Our targeted customers have historically built, maintained and operated communication networks, including private Land Mobile Radio (“LMR”) networks and supervisory control and data acquisition (“SCADA”) networks on narrowband frequencies licensed exclusively to them by the FCC. Based on our discussions with these targeted customers, these entities commonly express their desire to retain the positive elements of their aging LMR and SCADA networks, namely private ownership, tight control and custom features (such as specialized coverage and priority access), while adding the benefits of broadband and other advanced technologies (such as solving a broader set of use cases, including high-speed data transmission, video services and economies of scale). However, due to the general unavailability of low band spectrum (i.e., below 1 GHz), these entities have had limited opportunities to license or acquire the spectrum required to deploy cost-effective wireless broadband or other advanced technologies.

In contrast to legacy systems, the wireless broadband networks, technologies and solutions that can be deployed utilizing our spectrum assets can address the communication demands of the modern grid, both now and in the future. Our licensed 900 MHz Broadband Spectrum offers the assurance of absolute control over access to and use of that spectrum, allowing our spectrum to be utilized to provide customers with guaranteed levels of service and the ability for customers to prescribe and enforce purpose-built “rules of the road” for the provision of those services. Our spectrum assets can also serve as the foundational element to allow customers to implement LTE capabilities and evolve to 5G when there is a need. Recent FCC actions, including various auctions, have created significant opportunities for blocks of shared, unlicensed spectrum and/or licensed spectrum in the mid and high spectrum bands. The additional shared, unlicensed spectrum and/or licensed spectrum can enable future 5G networks, technologies and solutions. While we intend to build our existing and future business strategies around our 900 MHz licensed spectrum, the ability for our critical infrastructure and enterprise customers to combine our licensed 900 MHz spectrum with additional spectrum in one or more licensed, shared and/or unlicensed bands can provide them with an advantageous solution.

Disclaimer: The information provided in this report is for general informational purposes only and should not be construed as investment advice. The author of this article is not a licensed financial advisor and does not guarantee the accuracy, completeness, or timeliness of any information presented herein. Investing in securities or other financial products involves risk, and the reader should carefully consider their own investment objectives, risk tolerance, and financial situation before making any investment decisions. The reader should also consult with a licensed financial advisor or other professional before making any investment decisions. The author of this article will not be held responsible for any losses or damages resulting from any investment decisions made based on the information presented in this article.

Are there any resources to understand how and why utilities need this spectrum? What they have been using and new alternatives emerging?