U-Haul (UHAL) – A Good Business at a Good Price

Company Statistics

Executive Summary

U-Haul’s business, quality, and management are underestimated by the market. U-Haul (formerly Amerco) is the dominant do-it-yourself-moving (truck rental) and a top self-storage company established in the 1940s by Joe Shoen’s (current CEO) father. As of the latest report, the company has 189,000 trucks, 128,000 trailers, 46,000 towing devices ~22,000 independent dealers, ~2,200 owned stores, and 55M rentable sq. ft of storage.

I value the moving business at ~$42 per share and the storage business at ~$51 per share in a conservative base case scenario vs the current blended share price of $54.70. Taking the total net debt out gives me a value of ~$77 in my base case or ~41% upside. I also believe my bull case has a higher chance to occur than the bear case which you will see in the sum of the parts model later.

The company has strong, honest, experienced, and aligned management (family and employees own >50% of shares and have voting control) which has handily outperformed the market over time. Management thinks extremely long-term, resists the Wall St imperative, and has a strong capital allocation philosophy.

UHAL is the only game in town when it comes to the rental truck business in DIY moving and I believe has a greater than 60% market share. They have created a wide moat due to their network effect and brand in what should be a commodity offering. This business’s moat and cash flow have allowed them to expand into self-storage at attractive return levels. They have unique advantages in storage due to their moving business, and storage is a great cash-flowing business already. As storage growth continues, the overall business becomes higher margin, less capital intensive, and less cyclical over time. These characteristics typically result in multiple expansions especially given the increasing share liquidity and new potential sell-side coverage.

I believe there is an advantage in this name to doing the work and understanding the business. The company has financials with a lack of important disclosures (mainly the separation of moving and storage margins, but also not breaking out large expense line items), does not placate wall street, has low liquidity, no sell-side coverage, and is facing some shorter-term cyclical and comparable-related headwinds. There are no direct peers with both moving and storage, and there is no actual free cash flow returning to shareholders as it is usually spent on storage and increasing fleet. Given the above, in order to invest, you must think long-term, trust management, and be okay with large swings in reported metrics each period that you may not be able to perfectly model or explain. This takes out the vast majority of investors who are either focused on the short-term, have liquidity constraints, need management access, or need to accurately forecast the business on a micro level.

The company describes its own investment thesis far more succinctly than I do (and I agree with all below):

1. The leader in DIY moving and storage markets.

a. Most diverse product offering.

b. Largest fleet of rental equipment.

c. Ubiquitous brand name recognition.

d. Unmatched network of moving locations throughout North America.

2. Significant financial strength

a. Capex – ample opportunities to invest in growth.

b. Cash – conservative balance sheet to fund reinvestment.

c. Debt – manageable maturity schedule.

3. Long-term focus

a. Significant Shoen family ownership.

b. Managed to maximize long-term value.

The shares have pulled back from highs and are at an attractive discount to intrinsic value. Since I originally purchased shares (roughly around ~$45), management has made a few near-term value-enhancing moves:

1) A stock split to create liquidity in the shares as well as pay a consistent dividend to UHAL.B holders. I believe the lack of liquidity is the main reason this is not a more widely owned name. These new shares are non-voting, but the enterprise has always been family-controlled, so in essence, nothing has changed here. They do trade at a wide discount, which I don’t believe is warranted.

2) Changed the company name from Amerco to U-Haul. This is more symbolic but incrementally helpful to new investors or analysts discovering the business.

3) A desire to onboard sell-side coverage and be somewhat more interested in telling their story to the market. I believe this can be a very big deal in the short term.

Although these moves are not very important to the business's longer-term intrinsic value, they offer some potential shorter-term upside to the share price. Let’s get into each business.

Moving Business (Left: 2022 Investor Webcast chart showing strong revenue growth (10-yr CAGR ending ’21 was 5.3% - FYE is March), Right: my estimates of moving margins – inclusive of products/services/Ubox)

How it works

Based on personal experience, the process of renting a U-Haul truck is very simple. It costs around $19.95 flat to rent the truck, and you pay per mile for usage after. Additionally, they walk you through a series of ancillary products you can purchase (boxes, dolly, insurance, free storage for a month, etc…).

Many moves are within the same city and customers often pick up and drop off the truck at the same location. One-way moves are lucrative and UHAL does even better here given its network of locations.

Overall, revenue per transaction, (includes all DIY/moving/other revenues) as you can see below, has historically been around ~$150 but has moved up to around $200. UHAL has not increased pricing for a long time, but they generate significant operating leverage on increased pricing. I believe that recent price increases will not revert meaningfully, which should allow for higher normalized margins. I believe they have pricing power, but the company has always been focused on offering the lowest costs. The CEO has confirmed pricing increases will stay on recent calls. Please note the below are my estimates and not disclosed by the company and may differ significantly from actual figures.

Moat

UHAL has roughly 10x the number of trucks and 20x the number of locations as their nearest peers (Budget, Penske, Ryder). This network effect is the crux of the moat as the number of locations and trucks directly correlates with customer convenience, price, and overall experience. The best convenience, price, and experience attract the most customers which attract more franchisee locations and so on. UHAL has one of the wider moats I have ever seen in their moving business.

UHAL’s name recognition and Google-like association with moving is a large barrier to entry. The company spends essentially nothing on traditional advertising yet has incredibly high unaided name recognition. Advertising expenses were $13.7 million, $18.0 million, and $13.7 million in fiscal 2022, 2021, and 2020, respectively. This expense is relative to an almost $6B total topline number in the TTM. This ubiquity and lack of spend enhance the moat as anyone who wishes to compete must provide a better product AND spend more to bring in customers as they are pre-programmed to go to U-Haul. A recent VIC article showed the magnitude of this advantage vs peers and Google trends is another easy way to verify this advantage.

Finally, UHAL is not making obscene margins despite all their advantages, so the competitor trying to replicate what they have does not have an easy or extremely attractive market to enter. Depending on how you calculate it (I use a FCF less maintenance capex approach in the numerator), I believe ROIC is roughly 10% over time. Moving is a capital-intensive business. Buffett mentioned investing in companies he would never want to compete with – UHAL certainly qualifies.

To better internalize the moat in moving, let’s do a thought experiment on barriers to entry:

1) Is it even possible to replicate the network base of UHAL? Maybe, but how long would it take to sign up ~22k dealer sites throughout the country and 2.2k of your own locations and what would it cost? You would have to pay current dealers more money. To give you a sense of this scale, according to Wikipedia, there are currently ~3k Chipotles, ~11k Dunkin Donuts, and ~36k Subways. On top of that, how much does it cost to create a brand like UHAL? It has taken UHAL 70+ years and billions of dollars to get to where it is today.

2) They currently own 189k trucks – these are expensive trucks, 128k trailers, and 46k towing devices. Other costs include logistics, technology, retail workers, etc… These costs are not one-time and require significant maintenance capex and opex.

3) Most importantly, and as mentioned above, even if one did this, there is not a ton of profit margin available. No one in their right mind is going to compete here. This is likely why their peers have backed off, why they have faced minimal disruption, and why they have continued to gain market share.

Other smaller areas of advantages are their technology (pick-up and drop-off on mobile) as well as the financing strategy to grow their fleet with very low cost of funds which are not available to peers. A quick example of technological advantage is U-Haul’s app having 215k reviews while Penske has just 27 (27 total not 27k).

The only legitimate threat worth pointing out is autonomous trucking, but in my view, this is well outside the time horizon of the long-term investor, and even still, I think UHAL would evolve to become a player. I doubt someone in autonomous vehicles is salivating at getting into the personal moving market with a $200 average transaction price. AVs are likely more of a threat to the Ubox business as opposed to the traditional moving business. The other threat is Ubox self-cannibalizing the moving business which I think is possible for long one-way moves, but ultimately, the product and PODS have been around for a while and have not had any visible impact on the business.

Moving Industry

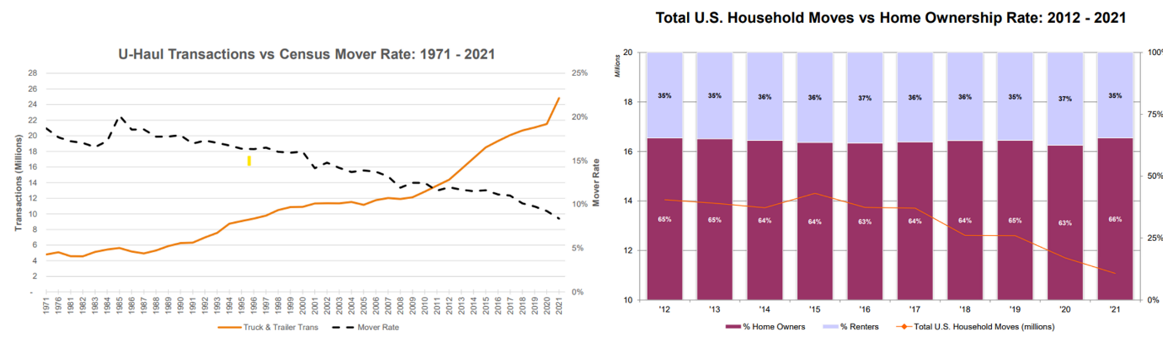

There is limited information, but using various sources, the total moving market is anywhere from $15-$20B and is thought to grow in the low single digits. The TAM is still majority professional movers (based upon UHAL’s revenues/market share vs TAM). Drivers of industry growth include population growth, moving rates, renting vs owning rates, interest rates, inflation, and more. However, the company supplies images below showing the moving rate has plummeted over time, yet UHAL’s transactions continue to increase.

Importantly, this industry will always exist in some form as people don’t move very often (but will always need to move for a variety of different reasons), and are thus unlikely to purchase their own truck, which means renting will always be the more sensical economic option. I like to bet on things not changing vs things changing. UHAL strives to increase its edge over time in providing a service people will always need where there are minimal comparable alternatives.

Market share – UHAL has and will continue to gain share from both of their main competitors:

A generous friend with a truck/van

UHAL continues making the experience better for the customer with technological advancements, convenience, and affordability. It is becoming harder to justify to your friend with a truck that their time/effort saves you enough money/time relative to a U-Haul. For a simple in-town move, UHAL can be less than $75.

The friend is only a competitor for small, short distance moves as friends typically don’t have the size of vehicles offered by UHAL. These are also the least valuable moves for UHAL.

More expensive professional moving services

UHAL is far cheaper and offers the largest network of movers to their customers to provide a similar service as other professional moving services for lower costs.

There will likely always be some high-end portion of the market that UHAL won’t capture, and I think they are okay with that.

Their peer competition is weak with both Penske and Budget spending less on DIY trucking than they have in the past. Neither views themselves as competitors or DIY moving as a material portion of their business.

Moving rate – Although I am skeptical of this statistic (as moving rates dropping in ’21 seems unlikely to me), if it were to be reversed it would be a massive tailwind for the company. Perhaps this is more likely in a normalized future (when interest rates aren’t increasing quickly) due to increasing polarization, remote work, etc…

Interstate one-way moves – Interstate moves are incredibly valuable for UHAL, and they have a monopoly in this area due to their competitive advantages discussed above. These are very profitable moves and were a clear tailwind in ’21 and ’22 and are likely at least 5x the cost of intrastate moves. UHAL can also charge more and use the customer to move their trucks to optimal locations for increased utilization. I think there is a secular tailwind here for the reasons discussed above.

As the percentage of renters increases, business gets better, which has been a mild tailwind. Renters move multiple times more than owners. I believe this may also continue to be a tailwind as real estate becomes more institutionalized and housing becomes further out of reach for most Americans.

Value of the Moving Business

Storage Business (2022 Investor webcast charts)

How it Works

As a customer, most typically will book a storage unit online, drive their belongings to the location, and then load them into the unit. It depends on location, amenities, size, and length of stay what the cost of the unit will be, but generally, the first month will be discounted and you will be charged monthly thereafter.

Moat

UHAL’s moat in storage is not comparable to moving, but the moat it does have centers around the ability to have synergies with its moving business which is mainly lower acquisition costs to obtain storage customers. According to various research, CAC in storage is anywhere from $200-$800 per customer, and greater than 75% of users start their process online. To this, according to a sell-side survey, UHAL’s tenants are only half as likely to start their process for a rental via an online search. UHAL also offers customers free storage when they move (which is a common time when one would need storage) which is another nice low-cost CAC advantage and allows them to benefit from their established brand/business. This can allow for: a) better margins or b) lower prices for the customer.

Another somewhat unique advantage for UHAL is the ability to utilize old strip malls or places with large parking lots as storage and moving locations. Although peers and others have retrofitted this area for storage, UHAL can utilize them most effectively. Additionally, UHAL has focused its growth on the capability to build/convert vs buy capacity which has enhanced its returns relative to peers and is unique in the industry. They are not opposed to buying fully-occupied lots, they just think the prices are too high. I know an owner of a storage business where UHAL lost the bid for his assets due to their unwillingness to go above a certain price. Although anecdotal, I like this level of discipline. I believe the strategy insulates them a bit from industry oversupply and the newfound popularity of self-storage. Joe Shoen has a tremendous understanding of the business and flies around and individually underwrites almost all large storage purchases.

Understanding Storage within U-Haul

Due to U-Haul’s strategy, storage projects have a material upfront cost which has been a drag on margins as the portfolio has grown. Below you can see that when occupancy was much lower for the company, there were increases in the percentage of immature units which has now fallen to below 30% (my estimates of <3-year-old units). In 2016, the company started in earnest its build/convert strategy rather than buying occupied units. The company’s percentage of new units is much higher than its publicly traded peers which leads in large part to their lower occupancy figures (and my assumption of lower margins). UHAL has efficiency gains on the horizon and margins should march upward. Additionally, the company does underprice its units and is not as technologically savvy as its public peers. I believe they can raise prices or hold prices better than their peers given their lack of aggressiveness historically and there is also room for improvement in their level of sophistication.

Below you can see how they have built their storage empire which is not at all reliant on acquiring existing assets. This is in my opinion a competitive advantage especially when others are buying assets at expensive cap rates.

Industry

The storage industry has more reliable TAM figures, but it is still a bit uncertain given the level of fragmentation. The storage TAM is generally thought to be around $40-50B, growing at slightly higher levels to moving. Storage can be an attractive business as it has extremely high NOI margins (~70% industry-wide), low operating costs, limited risk of obsolescence, low capital requirements, and high switching costs which leads to pricing power. It has secular tailwinds such as WFH flexibility, increasing market penetration (more customers as a percentage of the population), increasing NIMBYism, increasing difficulty building new units, recurring instances which inspire storage needs such as moving, divorce, and death, as well as general population and wealth increases. Many operators have ancillary revenue sources such as insurance, selling small moving items such as boxes, and 3P property management.

Key drivers of industry performance are:

Occupancy Levels – basically supply and demand in each local market. Occupancy levels were at all-time highs during Covid (~95%) and this also allowed for pricing power. Supply levels also took a hit due to Covid-related delays/worries as well as labor costs after a meteoric ~15%+ supply expansion from ’16-’19. We are likely to see some reversion here at all levels.

Pricing power – Analysts and experts generally believe storage can increase pricing every year. I am skeptical of this claim, but nonetheless, this is consensus and same-store increases have generally outpaced GDP over time. It is very interesting in that once you get someone in the door, their switching costs (likely renting a U-Haul and spending a day shlepping their things somewhere else) are extraordinarily high. What happens is these customers see very high price increases over time but will continue paying to avoid dealing with the problem, so even though the average user may churn in a year or two, over time this balances out with longer-term customers. The best (longest) clients ironically become the ones being charged the most.

Market Consolidation – The market today is incredibly fragmented with mom & pops being most of the competitive set. Consolidation would seem to make sense as the leader in the industry, PSA, by my calculation is <10% of the market. Public storage REITs in total are around 15%-20% of the market. These include Public Storage, Extra Space Storage, Life Storage, CubeSmart, and National Storage. Leaders will have advantages such as brand, centralized systems lowering costs/increasing efficiency, sophistication, and lower cost of capital.

Generally Commoditized Offering – The user of the product doesn’t use it very often, so the customer experience is driven by price and location rather than any amenities which means the difference between a state-of-the-art unit and a shed outside is minimal to many customers. You will not have the ability to charge a customer 2-4x because your unit is temperature-controlled and located in a certain area and this is different than in other industries such as commercial real estate.

Value of the Storage Busines

Importantly, they are running through depreciation in storage which leads to understated in this case “NOI” as I calculate it. Remember, I am separating segments in my valuation that the company does not. My NOI for storage and my EBIT for moving will add up to the company’s disclosed EBIT figure. This is different than how storage comparables are viewed. The company disclosed $54M of depreciation related “mostly” to buildings/improvements in the latest quarter, (let’s just use $200M annualized for these purposes) which unlike rental fleet depreciation is largely going to lead to increases in the longer-term value of the business and in my opinion is not really an expense and is non-cash.

Storage maintenance expenses are likely very low, even if I am very conservative at $40M of maintenance capex (indicates >5% of storage revenues which is much higher than industry at ~3-4% my actual guess would be $25-30M), this indicates understated operating earnings of $160M. Let’s even assume $60M is unrelated to storage properties and should run through the income statement (my actual guess is maybe its half of this), leaving $100M of phantom expenses. At a 15x multiple of this “NOI”, we add a not insignificant $1.5B to Storage market value or ~$8/share. I would also note that UHAL’s storage business is not too dissimilar from Life Storage which was just purchased by Extra Space Storage for a $16B+ Enterprise Value which lends some credence to the above values that my model spits out.

Understanding Margins (Left: Investor Webcast Chart, Right: My guesses for margins of each segment over time)

Right now, U-Haul is seeing margin declines vs FY ‘22 which should have been obvious after the performance in ’21 and ’22 and a clear investment cycle from ’16 to ‘20. However, longer-term margins should expand from retrenched levels over time due to operating leverage and most importantly to the increasing percentage of the business attributable to self-storage. Importantly, we are not seeing meaningful downturns in margins in self-storage (my estimates) despite industry weakness due to increasing unit maturations.

As revenues increase in storage, there will be minimal incremental costs besides the opening of brand-new units. New units are immature and thus have low occupancy (ex: In 2020, 5.8M net rentable sq ft added at 2% occupancy.) and are losing money with expenses already implied in the income statement. As these mature, all revenue increases drop to the bottom line. In my view, the multiple one places on UHAL storage could likely be higher than peers despite lower occupancy metrics for this reason. UHAL is not a REIT, so it should be penalized at some level for the lack of tax advantages and its opaqueness. In moving increasing utilization leads to much higher margins due to a lack of corresponding expenses (besides truck maintenance) which we saw in FY ’21 and ’22.

The majority of the company’s costs consist of personnel, maintenance expenses, and liability costs to the fleet. Other smaller costs are taxes, commissions to franchisees, and largely variable freight expenses. Personnel, maintenance, and liability are largely fixed in nature given the company’s business although there are components of variability (maintenance cost will increase if fleet is older/driven more). Management has said incremental margins are above 50% and they were >70% during periods of Covid.

UHAL reinvests its cash flow back into the business in what I believe are attractive opportunities. However, this does not allow the shareholders to see cash flow come back to them via dividends and buybacks, and it’s very difficult to analyze how much value was created due to their storage expansion. We can see in 2021 when the company was worried and slowed its investments just what type of cash flow this business can generate. Before growth capex, by my estimates, they generated approximately $1.25B in FCF in FY ‘22.

Management believes that good EBITDA margins for the company would be in the mid to high 30s with operating margins in the low 20s. I think these are realistically achievable in a normalized environment and if you underwrite to below these margins, returns are still attractive. Management also maximizes for cash flow and will expense anything they can to lower reported income and cash taxes paid. Because of this, analyzing the financials is nuanced and year to year changes can be wider than expected.

Management

Management is one of the more exciting parts of this investment. Joe and brother Mark Shoen are the two largest owners of the company. Since 1994, the company has more than tripled the returns of the S&P. The management team is laser-focused on their 10-yr time horizon and maximizing long-term shareholder value. This ownership mentality trickles down to employees who own >5% through the company’s ESOP plan. The CEO stokes this culture by being in the trenches with employees, constantly being at locations doing tasks of minimum wage employees and promoting from within. He also gives out his personnel cell phone number and answers customers’ inquiries taking customer calls daily to stay close to the business. He will also answer text messages. He has store managers give out their personal cell phones and his kids have worked at the business since their teens in a show of dedication from top management to the business and the customer.

Joe does not do any media, does not talk to Wall St., flies around visiting potential storage locations, and talks about long-term value creation. He is extremely cheap and constantly worried and absolutely ruthless with all competition. These are qualities most value investors adore, and we certainly have them with Joe Shoen.

We can also see this through the compensation structure. No one is getting rich from free stock options and outrageous bonuses. Joe pays himself a million dollars and there is no share dilution. Every business down to the store level is paid a portion of their compensation based on their PnL. The share count has remained remarkably stable over time.

Shoen often makes statements on transcripts referring to old-school value investing ideals and mentions other strong capital allocators such as Mark Leonard of Constellation Software.

Other Noteworthy Items:

UBox is a portable moving and storage box delivered to a location of the customers’ choosing. Essentially, big wood boxes are dropped off at a place where someone lives, the customer loads them, and then the box is transported for them to a new location rather than driving a truck yourself. It is also another feeder for storage. These are especially useful on long-haul or one-way moves. U-box is important because it shows that they are willing to spend to combat disruption and innovate. Sam Shoen, the likely next CEO, and son of the current CEO, oversees this business. It is profitable today, the leader in the industry, and is likely doing ~$400M of annualized revenues. This is not disclosed but makes up most of the “other” revenues category which has been growing extremely quickly (50% in 2022). This to me has real option value with just one other competitor called PODS.

UHAL does around half its moving business through its owned locations which are roughly 10% in number relative to dealer locations. You can back into this by understanding the commission structures and commission expense disclosures. Over time the company’s locations are growing more quickly than franchisee locations which should lead to revenue growth and perhaps some margin expansion.

Land and buildings value is likely to be understated on the balance sheet. Today they have $18.1B in assets, $1.5B in land, and $6.7 in buildings. UHAL has owned some land and buildings for 50+ years, and thus these are likely to be on the BS at a severe discount to their replacement cost.

Finally, the company has an insurance business which I value at slightly above book.

Valuation

Concerns and Risks

The main concerns are generally short-term in nature:

High-interest rates could decrease the moving rate and raise cap rates in storage. Other macro concerns.

Pushback: the moving rate has been decreasing for decades and it has not affected the moving business or the storage business. Additionally, this can help with storage units as people leave their stuff in units for longer (these customers are charged the highest rates).

The storage business is fragmented, with low barriers to entry, and is arguably moving into oversupply. Occupancy levels reached highs during the Covid-elevated periods.

Pushback: oversupply mitigated by high rates, labor costs, and supply chain, as well as UHAL’s unique properties, price discipline, and ability to utilize areas competitors can’t. Occupancy will move downward to historical averages and pricing will normalize. Competitiveness in customer acquisition favors UHAL on a relative basis due to its low CAC. Buying the company at a discount to intrinsic value to account for these risks is important.

Management generally doesn’t speak to investors and is not “Wall St” friendly.

Pushback: I view this as a positive, most value investors will if you read the transcripts

Valuation is not screaming cheap and depends on high storage multiple.

Pushback: I tend to agree that it isn’t silly cheap here, but it is still attractive. Luckily this stock has been volatile, and Mr. Market has given investors opportunities to purchase at large discounts to intrinsic value. Around ~$45 is where I would back up the U-Haul. Storage valuation being underpinned by current market M&A.

Succession Planning

Pushback: I like Sam Shoen and think the business can continue doing well over a long period of time even without Joe Shoen.

Technological disruption such as autonomous vehicles or a better version of self-storage where goods are transported to a location outside of a city center and delivered back to the customer when they want it..

Pushback: Unlikely to occur in the next 10+ years in my view.

What to monitor

To monitor UHAL’s progress I will monitor KPI’s largely discussed above. Moving and storage growth (and how this growth is accomplished whether via pricing, occupancy, utilization, etc…), operating leverage off of normalized figures, management execution, capex spend, and normalized FCF.

Potential unexpected upside could stem from value realization of the storage business through a spinout or a breakout of each segment, a potential sale of the business, increasing liquidity, or a few sell-side analysts explaining the value to the market. This will allow models like mine to be more correct and easier to understand for new investors.

Other important resources

There is a very bizarre backstory about the family and company control. I am only comfortable here due to the period of time that has passed and the performance of the management team. See this Forbes Article

Great past writeups:

https://moiglobal.com/amerco-thesis-201901/

https://valueinvestorsclub.com/idea/AMERCO/8210398636 - many other writeups here as well

https://www.kerrisdalecap.com/wp-content/uploads/2013/10/Amerco-Full-Writeup-Oct-2013.pdf

Podcast and Writeup: https://twitter.com/SleepwellCap/status/1407325809937850369?s=20

Disclaimer: The information provided in this report is for general informational purposes only and should not be construed as investment advice. The author of this article is not a licensed financial advisor and does not guarantee the accuracy, completeness, or timeliness of any information presented herein. Investing in securities or other financial products involves risk, and the reader should carefully consider their own investment objectives, risk tolerance, and financial situation before making any investment decisions. The reader should also consult with a licensed financial advisor or other professional before making any investment decisions. The author of this article will not be held responsible for any losses or damages resulting from any investment decisions made based on the information presented in this article.

Good article. The only point of agreement that I have with you is that U-Haul's scaled dealer infrastructure provides tremendous barriers to entry. I think that you take the data of declining movers rate a little too lightly. Movement is often a result of major life events like marriage, a new job, birth of children, and sometimes death. Americans have been moving from one residence to another less and less over the years as a result of various factors. Just to name two that quickly come to mind:

1. lower marriage rates: ~80% of all households were comprised of married couples in 1949 vs. ~50% as of 2020. The less these events take place, the less movement will be generated as a result of marriages.

2. increasing share of women participating in the workforce: ~30% of married households in the U.S. were dual-income vs. 50% today. Moving decisions become incrementally harder to make when they affect two as opposed to one person.

Also, I'm not sure that COVID provides good indication of what the future of movement/migration might be. As remote-work accommodations gain greater acceptance amongst employers, getting a new job becomes less of a reason to move residence.

U-Haul has been able to grow decently over the years due to share gain and rental penetration. On a forward basis, it's worth thinking about how much of these two levers they've already exhausted before being squarely correlated to the actual number of moves that take place in the U.S. To give you an example in another industry, Booking Holdings (NASDAQ: BKNG) historically grew 30-40% because a percentage of that growth came from (a) online penetration of travel (i.e., more people booking travel accommodations online), (b) OTA share gain in online channels (i.e., OTAs or Online Travel Agents like BKNG taking share from hotel websites as less people booked accommodations on Marriott.com and increasingly went to BKNG), and (c) BKNG share gain from other OTAs as the company acquired competitors. On top of all this, there was also the natural tailwind of more people traveling as average income levels rose. Today, BKNG has exhausted levers (a), (b), and (c). They're left with the raw demand for travel, which is still strong but definitely not 30-40% as history had it.

Another thing, I'm not sure that SOTP is appropriate here. If equipment rental and storage benefit from the synergies you articulated, which I tend to agree with, then separating both businesses may yield results different from what you're seeing presented today. For example, do they still enjoy lower CAC if both businesses are separated?

Lastly, many argue that the company deploys a scaled economies share model (you can track this by dividing rental revenue by gross equipment PP&E over the years - it's been declining, maybe intentionally?). I'm not sure that scaled economies shared is a sound formula to use in the face of structurally declining end-market demand. With ROIC of ~11% on avg. from 2012-2019, it's worth asking if that's an acceptable starting base from which to make projections. As businesses grow larger, the opportunity set shrinks. With the current capital allocation policy, I'm not sure that investors are being compensated for the risk of what's always an unknown future, though in U-Haul's case quite predictable.

Great article! Also, shares have moved nicely lately. Congrats if you participated in the move.

How did you calc revenue / transaction? I don't believe they disclose it explicitly..